May 5, 2022

Leverage Your Hospital Outpatient Pharmacy for Employee Benefit Costs

Hospitals who leverage their owned pharmacies for employee medications can easily reduce pharmacy benefit costs by 10-20%.

This is the first of an ongoing series on the topic. To see other articles, please click on teh links below:

Part 2: Own-Use Pricing and 340B Benefits

Part 3: Leveraging Increased Buying Power with Suppliers

Hospitals who have launched outpatient pharmacies have reported that the savings realized by the employee prescription benefit plan is the second largest overall benefit from the pharmacy operation (profits from specialty drug sales are first).

As a first step to achieving these savings, hospitals can look to eliminate the PBM spread by contracting directly with the hospital pharmacy. In doing this, the hospital would still likely maintain the PBM’s involvement for member services and claims adjudication.

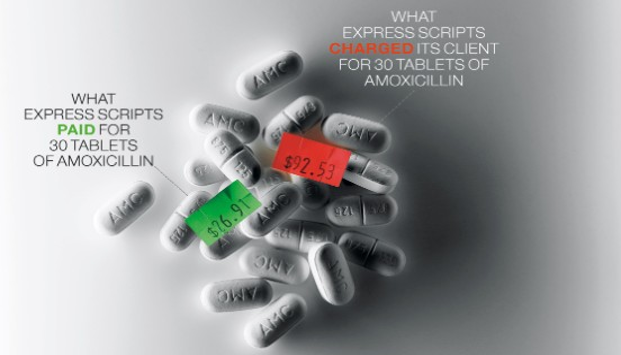

The graphic above shows some research from Meridian Healthcare. The hospital’s pharmacist dug through the employee’s benefit bills to analyze the PBM’s spread on its drugs. One example he found was for generic amoxicillin — Meridian’s HR department was charged $92.53 for an employee fill at the hospital outpatient pharmacy, but the PBM paid the pharmacy $26.91 to dispense that same prescription. Therefore, before even realizing anything like GPO or potential 340B savings, the hospital paid an additional $65 to the PBM. In another instance, Meridian was billed $26.87 for a prescription of the antibiotic azithromycin, while the PBM paid the pharmacy $5.19, creating a spread of $21.68.

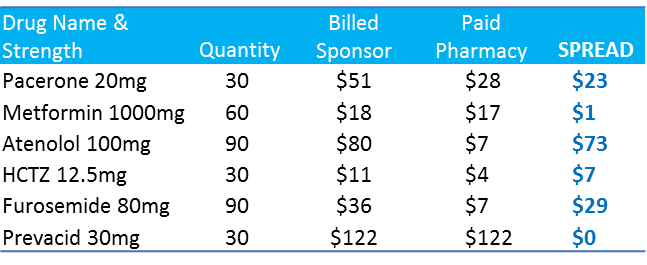

A study by Creighton University Medical Center reported the following spreads across different employers:

Consider the significance of this spread when it comes to specialty drugs. Specialty drugs currently account for around 35% of total drug spend and are forecast to grow to 50% by 2020. Therefore, while already a very significant cost to employee benefit costs, it is going to represent an even larger portion over the next few years.

To show an example of how specialty drug spreads can quickly add up:

The spread charged by a PBM is often calculated as a percentage of cost, so a 2% spread on a $20 per month maintenance drug is a fairly negligible $4.80 per year. However, a specialty drug with a cost of $5,000 per month at that same spread adds up to an additional $1,320 per year. Considering even the smallest hospitals can have 1,000 employees, it does not take long to see hundreds of thousands of dollars in savings. Larger health systems have been able to realize millions in prescription benefit savings through better eliminating the PBM spread through better utilization of their outpatient pharmacies.